Denkavit Utilising M&A to Stay Top of Young Animal Nutrition Industry

09 Jun 2020 Source: Denkavit via Feedinfo News Service

In the competitive young animal nutrition market, Denkavit is trying to offer unique products to meet the needs of its customers in different markets around the world. Their approach has been radical, to effectively leverage M&A activity and strategic partnerships to keep them at the forefront of the industry. Henk Botter, Denkavit’s Commercial Director and Tineke Dekker Denkavit’s Marketing Strategist spoke to us about these strategies. Initially, we wanted to understand what changes they have made to make the company stand out as a leading player in the market.

Be the most attractive partner globally

“Our mission is to be the most attractive partner globally in young animal nutrition, veal and special ingredients and we have taken several steps to get where we are today,” Mr Botter told us. “We have increased our R&D capacity, both in human resources and facilities, to be able to put more effort into researching the field of young animal nutrition. We have built a new pig farm as part of our DenkaFarm Innovation Centre, where we produce 8,000 piglets annually. Also further strengthened cooperation with several international players in the animal nutrition industry. Our believe that strategic partnerships are important to allow us to grow with our partners and take our business to the next level.”

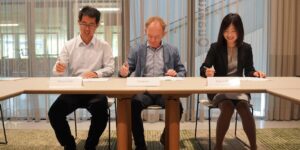

Mr Botter added: “Another way to grow and become more specialized in young animal nutrition is by taking over other companies. We have a focused acquisition policy, to fulfil our goal of having a significant presence in markets that are important for our growth and also to gain access to dairy raw materials to secure the supply to our factories. For example, the acquisition of the feed division of Vreugdenhil, 6 years ago gave us access to infant formulas and other high-quality side streams coming from the dairy industry. This approach makes us less dependent on price fluctuations in the market and also fits with our sustainability strategy focused on circular economy. More recently we have taken over companies in Italy and the USA and created our entity in cooperation with our distributor in Spain.”

Bolster the strategic reach of the company

Denkavit’s Commercial Director explained that these acquisitions were made to bolster the strategic reach of the company globally: “The United States is one of the largest milk-producing countries in the world with great market potential. However local presence is the only option to participate in this market as import taxes make it very difficult for us to import our products. The acquisition of Grober’s U.S.-based subsidiary Grober Nutrition Inc. supports Denkavit’s ambition to become a global leader in calf milk replacers in all major dairy-producing countries. It also made sense as Grober and Denkavit have been working together for 30 years and have similar values and an aligned commitment to quality and excellence in feed ingredients.”

When it comes to European partnerships and acquisitions, Mr Botter pointed out: “In Spain, we had been working with our distributor Dinuvet for many years. Spain is a growing market, especially in the field of dairy farms (cows, goats and sheep), and is already the biggest pig market in Europe. Both of our companies wanted to support our partners in this market and by working together as Denkavit Iberica we could make this possible. This new structure helps to bring innovations to the local market faster and meets the ambitions of both companies to further increase our market share in this region.”

Italy a very important market

“Italy is a very important market for us as it is one of the biggest markets for veal meat consumption in Europe. We have had a sales office in Italy for more than 25 years but to grow our local business and secure the supply of raw materials, acquiring a local player was the logical next step. In Italy there are two local milk replacer companies, so we bought one of the two: the family-owned company Frabes. With this acquisition, we can produce milk replacers locally but also produce our own Whey Protein Concentrate (WPC) which is an important raw material for our products. Due to owning drying facilities ourselves, we can dry dairy raw materials which makes us less dependent on world dairy markets,” Mr Botter added.

This period of growth for Denkavit means an opportunity for the company to understand the true challenges being faced by their customers so they can meet their needs most effectively.

Ms Dekker explained: “We deliver our products mainly to B2B companies, like compound feed producers and international distributors that sell animal nutrition products or a complete portfolio of products to farmers. We are following trends in the market and work with universities and research institutes to make sure we always have an answer to the challenges our customers face. Our customers rely on us to provide knowledge on young animal nutrition, so we have research facilities to perform all kinds of trials, develop and test new concepts and even complete customer-specific trials.”

According to Denkavit, one of the biggest challenges for these businesses is the focus on antibiotic reduction due to antimicrobial resistance.

“For companies looking at disease prevention, knowledge of nutrition can maintain or even improve farm performance and this is impacted by the use of raw materials and feed additives,” Ms Dekker commented. “We are expanding our portfolio of products for this goal, by doing research into new ways of preventing major diseases and testing what alternatives exist to prevent animals from getting ill.”

“Another challenge we have seen emerging are new demands from retail and consumer organizations who are imposing more and more specific requirements which farmers have to fulfil. Requests include locally produced raw materials, GMO-free feed and sustainable raw materials. We can react quickly to these new developments, and through producing customer-specific concepts we can handle local requirements,” she added.

“For our customers, governmental regulations and restrictions are still a challenge. The implications of legislation concerning the castration of piglets, tail docking and zinc oxide usage have been huge and our customers require in-depth knowledge to be able to cope with restrictions. At Denkavit we are continuously looking for new concepts and products to support our customers in coping with these emerging challenges,” Ms Dekker went on to say.

At present it is clear animal nutrition markets have been impacted by the COVID-19 pandemic, so we asked how COVID-19 has affected Denkavit.

Family-owned company

“As a family-owned company, the safety of our workers is our number 1 priority. As we are part of a ‘vital sector’, our factories continued production throughout the pandemic, so we took measures to be able to fulfil the demand for our products,” Mr Botter replied. “This meant some changes to normal roles and even members of our sales team started to work in the factories to help out when we had a shortage of employees. For the rest of the organization, it’s more or less business as usual. Of course, a challenge we have faced is that we have been unable to visit our customers, but with online possibilities, we’re still able to share our knowledge and support them effectively.”

Having had such a busy few years in terms of acquisitions, growth and adopting new approaches to R&D, Mr Botter explained what he believed would be Denkavit’s focus for the next 3-5 years.

“We have several strategic objectives. First, we will focus on new raw materials as we want to create more sustainable products and also are finding some raw materials harder to source due to market volatility and availability. Denkavit is working with research institutes, universities, partners and even start-ups to create solutions. Developing long-term partnerships is important for our business and we find that if all parties benefit you’ll get to exceptional results, which fits well with our motto: ‘Growing Together.”

For Mr Botter, young animal nutrition as a stand-alone physical product is likely to disappear in several years, and what will last are concepts in which nutrition is combined with other products, knowledge and support. By combining several disciplines (like nutrition, animal health and production technologies), he sees his company creating new concepts that will help farmers to improve the quality and health of young animals. “Innovation is one of our core values (next to quality, integrity and care). We invest a significant percentage of our revenue in innovation, not just to improve existing products, but to fulfil the unmet needs of our customers related to products, services, knowledge and completely new novelties.”

Veal the difference

“A few years ago we launched our vision ‘Veal the difference’, to improve the connection between dairy and veal farmers. We believe that these sectors should work together to improve the quality and sustainability of rearing dairy and veal calves. In our ‘Program Calf’ project, young calves that leave dairy farms are kept in veal farms and data is shared to improve calf rearing. Participating farmers have been very positive about the data they receive and what they learn about the veal business, so we will be expanding this project. With more understanding of each other’s position, this will further strengthen the chain.”

“Integrating our new companies into the Denkavit Group is one of the other priorities for the coming years. It’s just one thing to take over a company, but to make it a success requires good cooperation and understanding of each other’s cultures, businesses and ways of working. We plan to start more new collaborations over the coming years, to strengthen our position in all growth markets and meet our aims of becoming the partner of choice in young animal nutrition globally.”